The amount of credit in an economy is governed ( how often that word crops up when on this subject ! ) by the controls and levers held by the government and/or operated by it’s appointed economic agent ( for example, in England, the BoE ). The government and in particular the Chancellor retain accountability.

These levers ( interest rates, reserve ratios, regulations ) can be moved at will by the government to affect the supply or demand of credit.

Not by the banks.

People are pretty much the same everywhere on the planet. Give them more money they’ll spend more. It’s always been so. Governments differ in how they move those levers. Some more cautious. Some full of confidence and bragging. The end of boom and bust ! But it’s not the banks in command.

Securitisation of loans has always been the case, it’s not new. No one has entered a building society for a £50K mortgage only to be told, I’m sorry sir, if you could just wait until a depositor arrives with at least £50K, we’ll be right with you. The securitisation of debt spreads and reduces the risk of default for the holder, increases the availability for the borrower, and lowers it’s cost. Nothing new. Securitised debt is sold between buyer and seller ( investors and borrowers, respectively ) with the banks being in the middle.

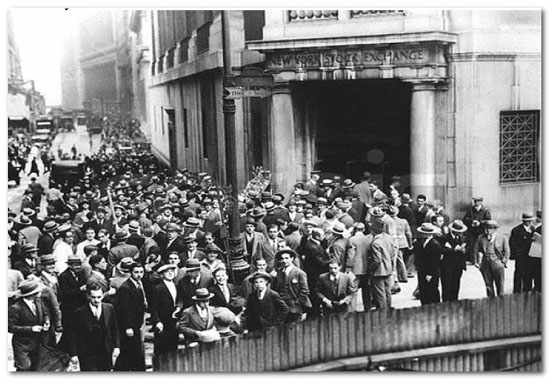

The same banks operating in the UK operate in other countries where there was no financial crisis. In Japan, the phrase is not “global financial crisis” at all by the way. It is just referred to as “Lehmann Shock”. Because all that happened was that that bank, which occupied a prominent building, was seen to close.

No other effect, no credit crunch, no whining at banks. Goldman Sachs, in the floor above Lehmann in the same building, carries on, as does RBS, as does JPMorgan … all the foreign banks in fact.

Same in other countries.

If it was a problem intrinsic to banks, these countries would have had a problem too. They didn’t. It’s country specific, and country-specific issues are caused by country-specific policies. The decision to remove credit controls and banking regulation in the UK and US was political. It could only be – as only the government has the power to do so.

It didn’t work.

Blaming the banks is akin to blaming the chef for overeating at a restaurant that keeps bringing food to the table – while the manager shouts how he has ended the cycle of gluttony and famine.

0 Replies to “Banker Bashing”